What is Transition to Retirement?

Want to start slowing down but not quite ready to say your final goodbye to the job yet? You can cut back at work and begin to access the benefits of your super in the years leading up to retirement with a Transition to Retirement (TTR) strategy.

Want to start slowing down but not quite ready to say your final goodbye to the job yet? You can cut back at work and begin to access the benefits of your super in the years leading up to retirement with a Transition to Retirement (TTR) strategy.

This strategy allows you to deposit some of your super savings into an income account as a transition to retirement member. You can then start receiving regular payments from this account, helping make up the difference in your salary from your reduced work hours.

Meanwhile, because you’re still working, your super account will continue to receive employer contributions and any voluntary contributions you make.

Watch this short video to learn about how Transition to Retirement works:

Who’s eligible to open an income account as a transition to retirement member?

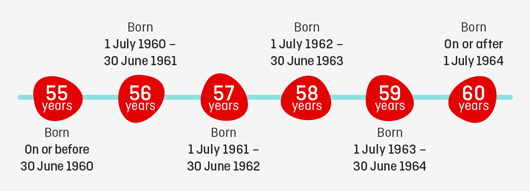

If you have reached your preservation age, you can effectively semi-retire and start tapping into your super by opening an income account as a transition to retirement member.

Find your preservation age:

Your transition to retirement account will automatically move to the ‘retirement phase’, where there is no tax on investment earnings, as soon as you turn 65.

It’s important to note that, if your preservation age is before age 60 and you choose to access your super before age 60, tax may be payable on the amounts you withdraw.

Opening an account as a defined benefit member

If you’re a member of a defined benefit division of Qantas Super, opening an income account as a transition to retirement member may have an impact on your benefit, so it’s important to seek financial advice.

You can get simple advice over the phone or face-to-face. It’s included as part of your membership, so there’s no extra cost.

How does it work?

Setting it up an income account as a transition to retirement member is easy. All you have to do is:

1. Transfer your super from your regular account to your new income account as a Transition to Retirement member

You must transfer a minimum of $30,000 to open an income account as a transition to retirement member in Qantas Super.

However, it’s important to note that there’s a limit on how much you can transfer into an income account once you become a retirement member. This is because the government has set a lifetime limit on how much super members can transfer from the ‘accumulation phase’, or a super account, to the ‘retirement phase’, or an income account as a retirement member.

This is called the ‘transfer balance cap’. The general transfer balance cap was indexed to $1.9 million on 1 July 2023, however the indexation means that there’s now no single cap that applies to all individuals. Instead, the Australian Taxation Office (ATO) explains that each individual has their own personal transfer balance cap, depending on their circumstances.

2. Decide how you want to invest your super

You can choose to invest the balance of your income account in the same options as your super account, or choose a new mix of options.

3. Choose how often you want to get paid, and how much you want to receive in each payment

To help you stick to your budget, you can choose to receive weekly, fortnightly, monthly, half-yearly, or yearly payments. Your payments will be sent directly to your nominated bank account.

However, minimum and maximum drawdown limits apply. You must withdraw between 4% and 10% of the starting balance of your income account as a transition to retirement member each financial year.

It’s also important to note that, when you turn 65, you will become a ‘retirement member’ – in other words, your income account will become an ordinary pension account. With this, your minimum drawdown limit will increase, and there will no longer be a maximum limit.

4. Sit back and let your income account do the hard work for you

While you cut back at work and dip your toes into retirement, your income account will be working hard to top up your income.

What happens to your super account?

Because you will still be working, your regular super account will need to stay open in order to receive contributions from your employer. With this in mind, it’s important to ensure that you keep enough money in your super account to cover any admin fees and insurance premiums.