Busting super myths

With $2.9 trillion* invested, Australia’s super system is routinely ranked among the top retirement systems globally. Given its reputation, it’s no wonder people like to talk about super.

Unfortunately, some of the things people say and hear about super aren’t always correct. To help you separate fact from fiction, we’ve busted a couple of common super myths:

The government can take my super

No, the government can’t take your super. Your super is your money and it belongs to you – it’s simply being invested for your benefit at retirement by your super fund. You can access it when you reach your preservation age and satisfy a condition of release.

However, there are a couple of special circumstances in which the government might have to step in and help you with your super.

For example, with the amount of lost and unclaimed super across Australia growing to $20.8 billion over the 2018/19 financial year, the government is working to reconnect Australians with money sitting in long-forgotten super accounts.

This is being done through a new law which requires super funds to transfer ‘inactive low balance accounts’ to the ATO. These include accounts that have a balance below $6,000 and haven’t received a contribution for 16 months.

Once received, the ATO will transfer these balances to a member’s active super account.

You get kicked out of Qantas Super fund when you leave your job, or after a certain age

No.

Qantas Super is designed to be with you from your first day on the job to the day you retire, and beyond. This means that, as long as you have a minimum balance in your account (which is required to ensure your balance isn’t eroded by fees) you will never be ‘kicked out’.

Should you leave the Qantas Group for a new job, you can keep your Qantas Super account open and make contributions to it directly via BPay. If you have another super account, you can also transfer funds to your Qantas Super account at any time.

When you’re ready to retire, you can then choose to open a Qantas Super income account. This lets you draw a regular income from the super you’ve saved throughout your career and, best of all, helps you remain part of the Qantas Super family.

I can nominate any friend or family member as a beneficiary

It depends. Legally, your super is designed to be passed to your dependants. A dependant can be your:

- Spouse: incudes married, de facto, and same sex

- Children: Includes biological, step, adopted, ex-nuptial, or your spouse’s children

- Financial dependent: A person wholly or partially financially dependent on you

- Interdependent: A person who you live with in a close personal relationship, where one or both provide financial support and domestic support, or personal care. Other circumstances may also apply.

So, if you make a binding nomination to an individual, they must fit into one of those categories.

If you want to leave your super to someone who doesn’t fit into one of those categories, such as a friend or charity, you can make this specification in your will, and then nominate your legal personal representative as your beneficiary. Your legal personal representative is the legal executor of your will, or the person responsible for your estate.

Watch this short video to learn more about the different types of beneficiaries:

I pay tax on my super

Tax on contributions

Before-tax contributions to your super are taxed at 15%. This includes the compulsory contributions your employer makes, as well as any salary sacrifice contributions you make.

Tax on earnings

Tax is applied to the investment earnings in your super account at a rate of 15%, and reflected in our credited interest rates (CIRs). However, investment earnings in an income account are tax-free if you are a Retirement Member.

Tax on withdrawals

If you are eligible and choose to withdraw money from your super before you turn 60, you will pay tax on any amounts you withdraw. Meanwhile, if you take any part of your super in cash after age 60, generally no tax is payable.

I can buy a house with my super

This one is a bit tricky – it’s not exactly a myth, but while you can technically buy a house with your super, it’s likely not as easy as you think. In particular, the answer depends heavily on who you are, and what type of house you are looking to buy and why.

There are two main ways in which your super could help you buy a house:

The First Home Super Saver Scheme

The First Home Super Saver Scheme was introduced by the government in 2017 to ease pressure on first home buyers facing rising house prices. The scheme allows Australians to access part of their super to help save for a deposit for a home.

If you are a first home buyer and both the following apply to you, you may be eligible to participate in the FHSS scheme:

- You either live in the premises you’re buying or intend to as soon as practicable; and

- You intend to live in the property for at least six months within the first 12 months you own it, after it’s practicable to move in (if you enter into a contract to build a home, the timeframe may be different)

Under the FHSS scheme, you can apply to have a maximum of $15,000 of your voluntary contributions from any one financial year included in your eligible contributions to be released under the FHSS scheme, up to a total of $30,000 contributions across all years. You’ll also receive the earnings that relate to those contributions.

There are a number of important things to know about the FHSS – you can learn more via the ATO.

Buy an investment property via a self-managed super fund

The other way you can buy a house with your super is by buying a residential property through a self-managed super fund (SMSF).

However, this comes with several caveats, chief among them that you can’t actually live in a residential property you buy via an SMSF. This is because every super fund, including an SMSF, must pass the ‘sole purpose test’, which is to provide a benefit to you in retirement, or to your dependants if you die before retirement.

Living in an SMSF investment property would mean you are receiving a benefit from your super before retirement, breaching the sole purpose test.

Along with this rule, any property you buy via an SMSF must:

- Not be acquired from a related party of a member of the SMSF

- Not be lived in by a fund member or any fund members’ related parties

- Not be rented by a fund member or any fund members’ related parties

What’s the point of super and why do I have to wait to access it?

The compulsory super system was launched in 1992 with the goal of helping people save for their retirement. The government has stated that the system’s aim is to provide income in retirement to substitute or supplement the age pension.

This is necessary because a single retiree currently receiving the full age pension and supplements in 2020/21 will receive just under $25,000 per year. Meanwhile, the Association of Super Funds of Australia (ASFA)’s Retirement Standard (December quarter 2019) estimates that a single retiree aged between 65 and 85 will actually need around $44,000 per year to enjoy a ‘comfortable’ retirement, or over $28,000 to enjoy a ‘modest’ retirement.

Super is designed to help Australians save throughout their working lives so they can bridge that gap at retirement and enjoy the life after work they deserve.

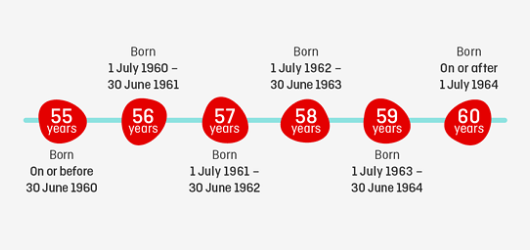

With that in mind, you generally have to wait until you reach your preservation age to access your super. Depending on the year you were born, your preservation age will be between the ages of 55 and 60.

I should switch my investment options when markets are volatile or drop

Everyone’s situation is different, so it’s always important to seek financial advice before you make a decision about your investment options.

However, though it may sound counterintuitive, conventional investment wisdom tells us moving your super to a lower risk option in a downturn or when markets are more volatile could actually mean you risk locking in your loss by selling out at a time when prices are low.

For example, let’s look at it in terms of buying and selling a house: if you bought a house for $1 million, and then house prices dropped and your home was valued at $750,000, you would only make a loss if you actually decided to sell it at this point.

Rather than jumping straight to switching, there are a few other things you may want to think about to ensure your super’s invested the right way for you over the long term.

I have to wait until I'm 67 to access my super

No. If you satisfy a condition of release, you may actually be eligible to start accessing your super when you hit what’s called your ‘preservation age’. This depends on the year were born:

If you’ve heard age 67, it may be in relation to the Age Pension, which you may be able to begin accessing (if you’re eligible) when you hit your ‘qualifying age’. Like your preservation age, this depends on the year you were born:

Was this helpful?

We're here to help

If you want to learn more or need help with making a decision about your super, you can get simple advice over the phone. It’s included as a part of your membership so there’s no extra cost.