Though it may have taken a few years, the launch of the scheme came just in time. With war in Europe declared on 3 September 1939, Qantas too went on a war footing.

Gone were the luxurious cabin services and cargoes of oysters on the Empire flying boats to Singapore; two of the six Empire boats and a number of Qantas pilots went to the RAAF, while military and government officials had priority on reduced services.

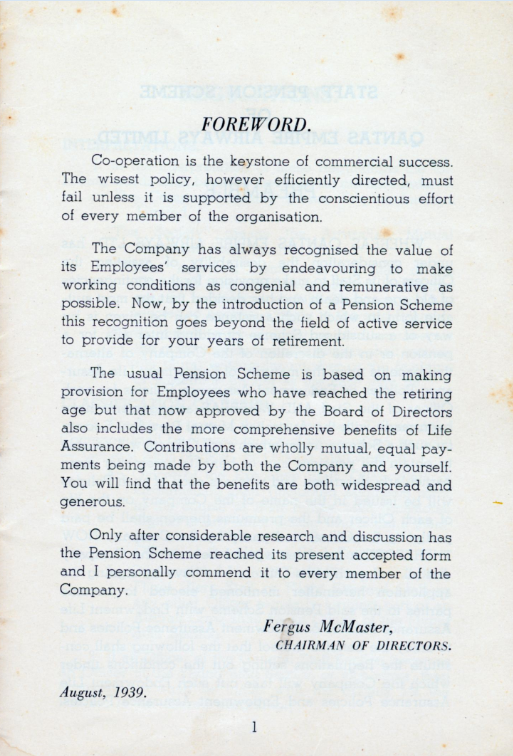

The protections offered by the Qantas Staff Pension Scheme were the saving grace for a number of Qantas employees and their families in this time.

Despite a long campaign by Fysh, Qantas staff and their dependants weren’t covered by war service benefits or payments, like those provided to merchant sailors. Instead, the Qantas Staff Pension Scheme provided support to a number of the families of the 17 Qantas staff who died by enemy action or accidents between 1939 and 1945.

The lessons learned in those impossible times have helped ensure the continued growth of Qantas Super. As it did through the war, the scheme has helped support Qantas employees through a multitude of changes over the last 80 years.

From Qantas entering government ownership under the nationalisation agenda of the post-war Chifley Government, to its privatisation and float in the 1990s, and onto the great technological change of the 21st century, Qantas Super has always been there.