How to start taking advantage of your super

Whether your job at the Qantas Group is your first full time role or simply the latest stopover on your career journey, now is the time to get excited about your super and learn how you can make the most of it.

Whether your job at the Qantas Group is your first full time role or simply the latest stopover on your career journey, now is the time to get excited about your super and learn how you can make the most of it.

What do you mean? Retirement’s still years away!

That may be true, but there’s actually a lot you can do with your super before you retire – and the day you open an account in your new super fund is the perfect time to start making the most of it. Whether your job at the Qantas Group is your first full time role or simply the latest stopover on your career journey, now is the time to get excited about your super and learn how you can make the most of it.

1. Making contributions could be a tax-effective way to invest

Putting your money into the super system is one of the most tax-effective ways of investing. This is because super funds pay tax at a special rate of only 15%.

If you earn between $45,001 and $120,000 a year, meanwhile, you pay 32.5% income tax for every dollar you earn over $45,0001. But if you sacrifice income for additional super contributions you could have more money working for you without doing anything extra.

Let’s look at Priya. Jess gets a pay rise of $10,000 a year. She has the choice to take this as fully taxable income or boost her super through salary sacrificing. Let’s look at the difference to Priya’s take home pay and super in each scenario, using MoneySmart’s income tax calculator.

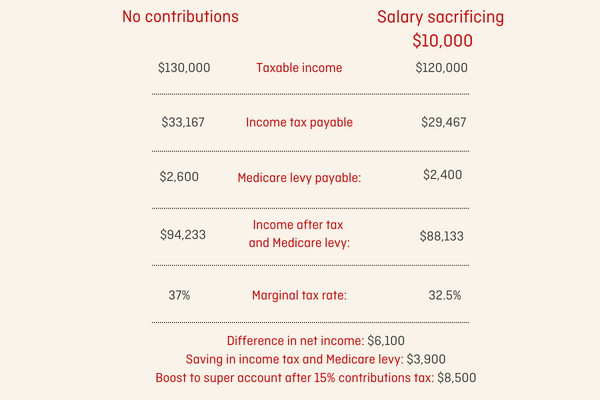

Priya earns $130,000. In scenario 1, she does not make any voluntary super contributions, and has no tax deductions. In scenario 2, Priya contributes $10,000 to her super via salary sacrifice. She has no other tax deductions.

For a $6,100 difference in net income, Priya has saved $3,900 in income tax and Medicare levy payable. Meanwhile, after applying the 15% contribution tax applicable to pre-tax contributions, Priya’s super account has received a boost of $8,5002.

1For 2023/24.

2These figures are illustrative only and were calculated using the MoneySmart income tax calculator www.moneysmart.gov.au (accessed 24 January 2024), using 2023/24 tax rates. Your marginal tax rate does not include the Medicare levy, which is calculated separately. The Medicare levy is calculated as 2% of taxable income for most taxpayers. The Medicare levy in the calculator is based on individual rates and does not take into account family income or dependent children. The calculator also does not include the Medicare Levy Surcharge (1%-1.5%), an additional levy on individuals and families with higher incomes who do not have private health insurance. These calculations do not take into account any tax rebates or tax offsets you may be entitled to.

Annual caps on contributions

The Government limits the amount of concessional (before tax) and non-concessional (after tax) contributions you can make into super.

If you exceed these limits you may need to pay additional tax.

2023/24 contributions caps

| Contribution type | Annual limit |

|---|---|

| Concessional (before tax) contributions | $27,500 |

| Non-concessional (after tax) contributions | $110,000 |

2. Save for a house with the First Home Super Saver Scheme

Buying a property is still, for many, the Great Australian Dream. Unfortunately, statistics show it’s getting harder for many Australians.

According to the Australian Bureau of Statistics, home ownership has fallen from 70% of households in 1998 to 66% in 2018 – the lowest proportion of home ownership since the ABS began tracking this data in 1994.

That’s why the Government introduced the First Home Super Saver (FHSS) Scheme in 2017. It aims to help more Australians buy their first home by giving them a vehicle through which to save up for a deposit.

If you’re a first home buyer and the following apply to you, you might be eligible to participate in the FHSS scheme:

- You either live in the premises you’re buying or intend to as soon as practicable; and

- You intend to live in the priority for at least six months within the first 12 months you own it, after it’s practical to move in.

Under the FHSS scheme, you can apply to have a maximum of $15,000 of your voluntary contributions from any one financial year included in your eligible contributions to be released under the FHSS scheme, up to a total of $50,000 contributions across all years. You’ll also receive the earnings that relate to those contributions.

There are a number of important things to know about the FHSS – learn more.

3. Make the most of the benefits on offer

We know it’s a long road to retirement – that’s why we offer a range of benefits that you can start taking advantage of now.

Our advice service, for example, allows you to speak to a Super Adviser over the phone or face-to-face at no additional cost. This service, along with our online education and range of seminars, can help you take control and set a plan for your financial future now.

One of our other great benefits is 360Health Virtual Care, a service offered through our insurer, MetLife. This service gives you and your immediate family confidential access to expert medical support and guidance from the comfort and support of your own home. When someone is facing a health problem they need clear, definitive answers and reassurance that the support they’re getting is the best available. 360Health Virtual Care helps where there is uncertainty by providing you with easy access to more than 50,000 leading general practitioners and doctors, specialists, and mental health clinicians globally who can provide confidence and clarity on any medical concern, helping you get the right diagnosis, treatment plan, and information.