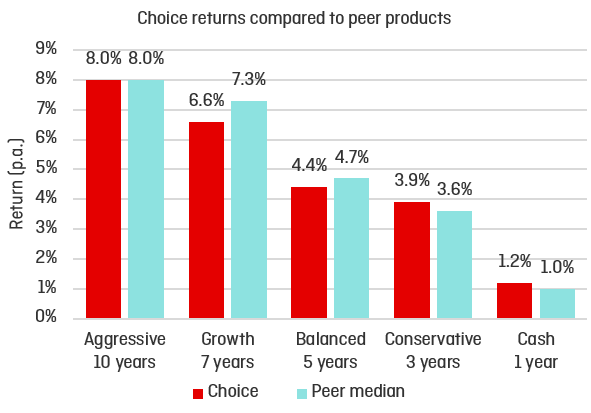

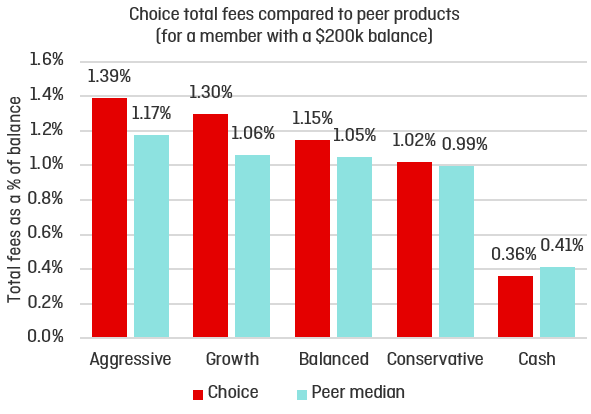

We used survey data from SuperRatings as the basis for our assessment of our choice product. At a total fee level (i.e. where total fees includes investment management fees, investment performance fees and administration fees), the investment options under our choice product generally have modestly higher fees than comparable products, with the exception being the Cash option.

The administration fees for the investment options of our choice product are comparable to the industry median and it is our investment fees that are generally higher. This reflects our highly diversified investment strategy which includes investments in various alternative sub-asset classes and which overall, as demonstrated earlier, has delivered returns (net of tax and after investment fees) that are comparable with the peer median. Looking ahead, we will continue to review our fees.

Fees for choice options are shown below in dollar terms for a member with a $200,000 balance. This is consistent with the average balance of members in our choice product.