What's changing on 1 July

Your maximum defined benefit will be calculated and combined with your accumulation accounts

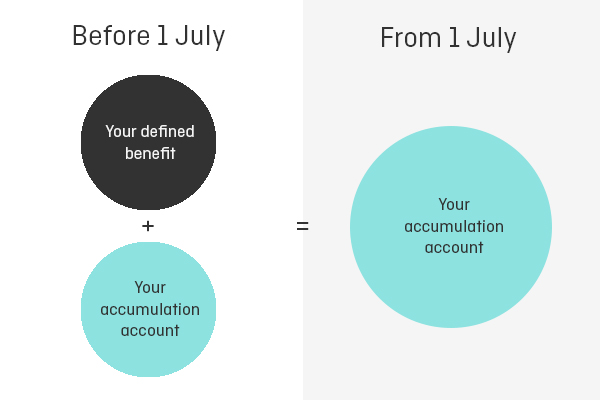

Because you are in a defined benefit division, your super is calculated according to a formula, which is a defined benefit amount plus your accumulation accounts.

You can choose how all of your super is invested

You might already be familiar with our range of investment options through your existing accumulation accounts.

From 1 July, all your super will be moved into a single accumulation account. This means you will have more control over how all your super is invested.

It’s important to make sure your money is invested to match your needs and lifestyle goals. We have created a range of investment options for you to choose from based on how much risk you are willing to take.

If you have already chosen investment options for your existing accumulation accounts, your total super as of 1 July will be invested in the same investment options, in the same proportion that applied to your existing accumulation accounts.

If you don’t choose your preferred option/s for your account balance as of 1 July and any future contributions, they will be invested in the default investment option. Currently for your division, it’s the Growth option.

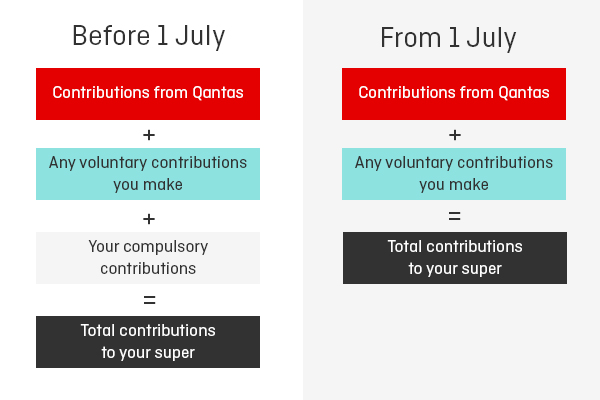

You no longer have to make compulsory contributions from your pay

Your standard insurance cover will end

Your standard death and disability insurance as part of Division 2 was always designed to cover you up until the 1 July following either your 55th or 60th birthday, and end at this date.

If you have any voluntary insurance cover in Qantas Super, this will continue until you reach 65 years of age, and insurance premiums for this cover will continue to be deducted from your account balance.

If you don’t currently have voluntary cover in Qantas Super, you can apply for death only or death and TPD cover, and it will continue to cover you until you reach age 65. If you are considering additional insurance, it’s worth noting that the cost of insurance premiums increase with age, so it’s a good idea to consider the level of cover you really need.

If you would like to discuss your insurance options, you can give us a call.

What's staying the same

You’re still in Division 2

You will remain a member of Division 2 in your new phase of super.

Qantas will continue to pay your administration fees and make contributions to your super

As a member of Division 2, Qantas has always paid your administration fees. This will continue, and can be a big saving.

Qantas will also continue to contribute to your super. Qantas will contribute at the Superannuation Guarantee rate, which is the minimum rate set by the Federal Government. Currently, this is 11% of your salary. This amount will increase to 11.5% on 1 July 2024.

If you make voluntary contributions, these will stay the same

Any additional amounts you’re putting into super will continue to be deducted from your pay.

Remember, there are limits to the amount of contributions you can make into super each financial year before you incur extra tax. Monitor the level of concessional (before tax) and non-concessional (after-tax) contributions made to your super.

The Superannuation Guarantee minimum benefit still applies

The safety net built into your defined benefit – the Superannuation Guarantee minimum benefit – will continue from 1 July.

What does it mean and what can you do?

After a lifetime of hard work, your super will no longer be a formula but a total balance you will have more control over.

It will be invested, and continue to accrue through contributions and investment returns.

We know it’s sometimes easier to have someone explain what’s changing.

If you would like to learn more, you can book a meeting with a Super Adviser to better understand your new phase of super.

Book in a 30 minute meeting with a Super Adviser to get a one on one look at your super.

Meet Sally...and Biscuit

Was this helpful?

Frequently Asked Questions

We're here to help

If you want to learn more or need help with making a decision about your super, you can get simple advice over the phone or face to face. It’s included as a part of your membership so there’s no extra cost.