The assessment of fees and costs considers the allocation of costs across the membership and compares the investment fees and non-investment fees to comparable products in the industry.

Based on the results of the assessment, we concluded that there is a fair and reasonable allocation of costs between products, divisions within the Plan, and the different types of members. As a not-for-profit fund, our fees are set at a level to recover these costs.

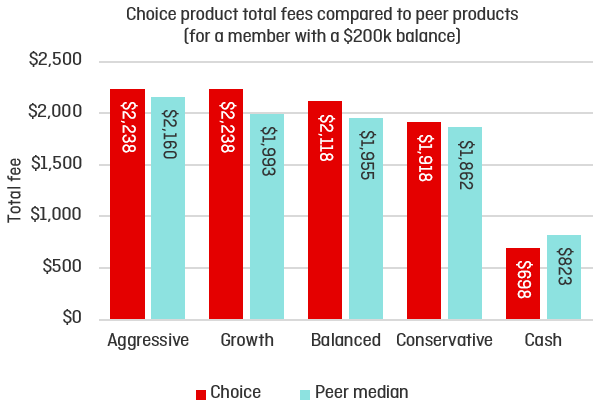

When considering fees and costs it is important to bear in mind that the benefits, services and facilities offered by funds are different. We are modestly more expensive than some other funds in the market because our offering is tailored to the needs and circumstances of our members; being current and former employees of Qantas Group.

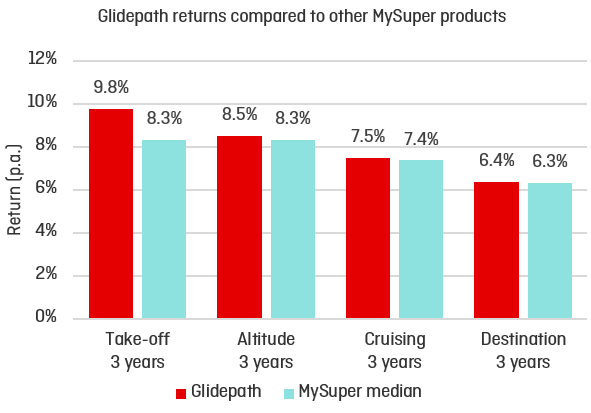

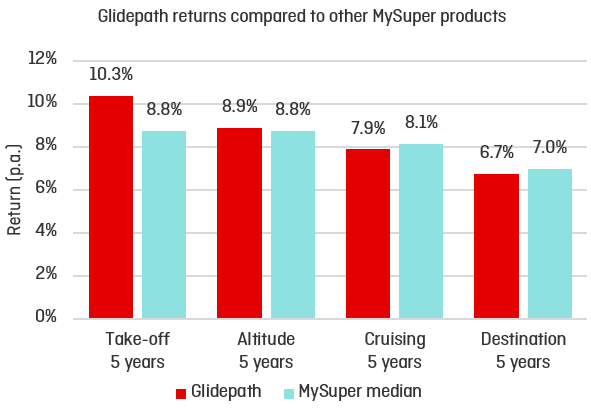

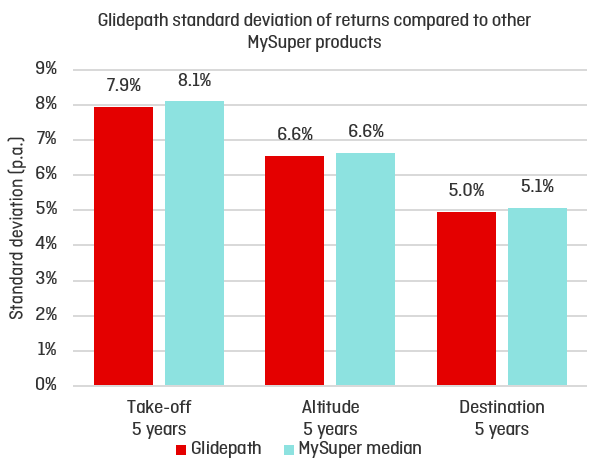

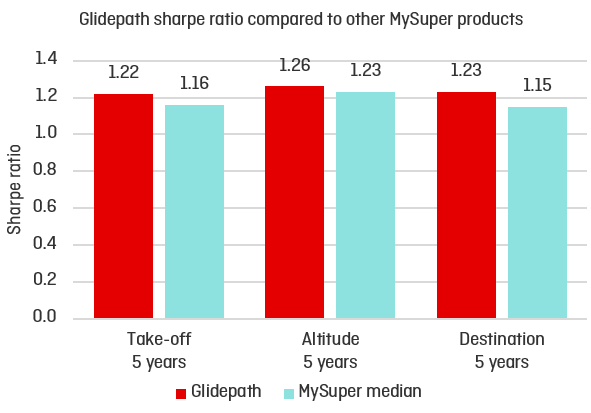

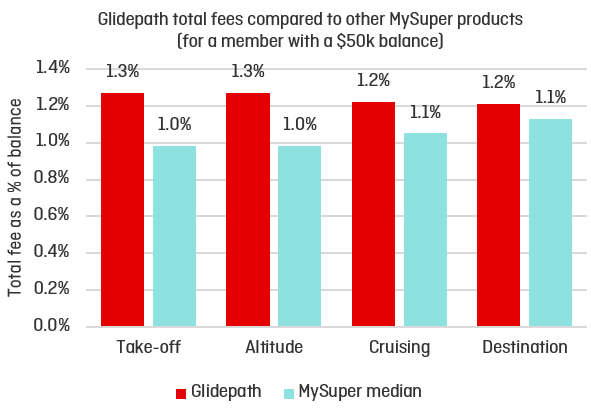

We’ve assessed each stage of our Glidepath investment option separately. We have taken this approach so that each stage can be more easily compared to other MySuper products. The outcomes and metrics on which we based this assessment are largely prescribed by APRA and we are required to use APRA data.

Fees (i.e. which includes investment management fees, investment performance fees and administration fees), for Glidepath are shown below as a percentage of balance for a member with a $50,000 balance (as required by APRA). In general, the Plan targets being good value for money for members. At 30 June 2021 the Plan’s total fees for Glidepath were greater than the median fees of comparable products in the industry. The members of the Plan enjoyed excellent investment performance for the year ending 30 June 2021, which in turn led to an increase in performance fee payments to our external investment managers, and this was a significant contributor to this fee outcome.

In addition, the Plan’s investment fees reflect our well diversified investment strategy, which includes allocations to various alternative sub-asset classes. While the investments within these alternative sub-asset classes have enhanced the return and risk profile of our investment options, they are also more expensive than traditional asset classes.

It is also noted that these results do not reflect the administration fee reductions made with effect 1 July 2021, and so an improvement on this result is expected to have now occurred.