Qantas Super Explores Merger Options

The Qantas Superannuation Limited (Trustee) Board believes that now is the right time to explore options to merge Qantas Super with another superannuation fund.

On this page

Overview

The Qantas Superannuation Limited (Trustee) Board believes that now is the right time to explore options to merge Qantas Super with another superannuation fund.

This conclusion was reached after carefully reviewing Qantas Super’s scale compared with leading superannuation funds, the fund’s growth path and the legislative and regulatory environment.

The Trustee regularly reviews its strategy for Qantas Super to ensure the fund is positioned to deliver great financial outcomes for members. Qantas Super is well positioned with competitive investment returns, products and services being provided to members, however given future headwinds, the Trustee believes it is important to explore merger options now.

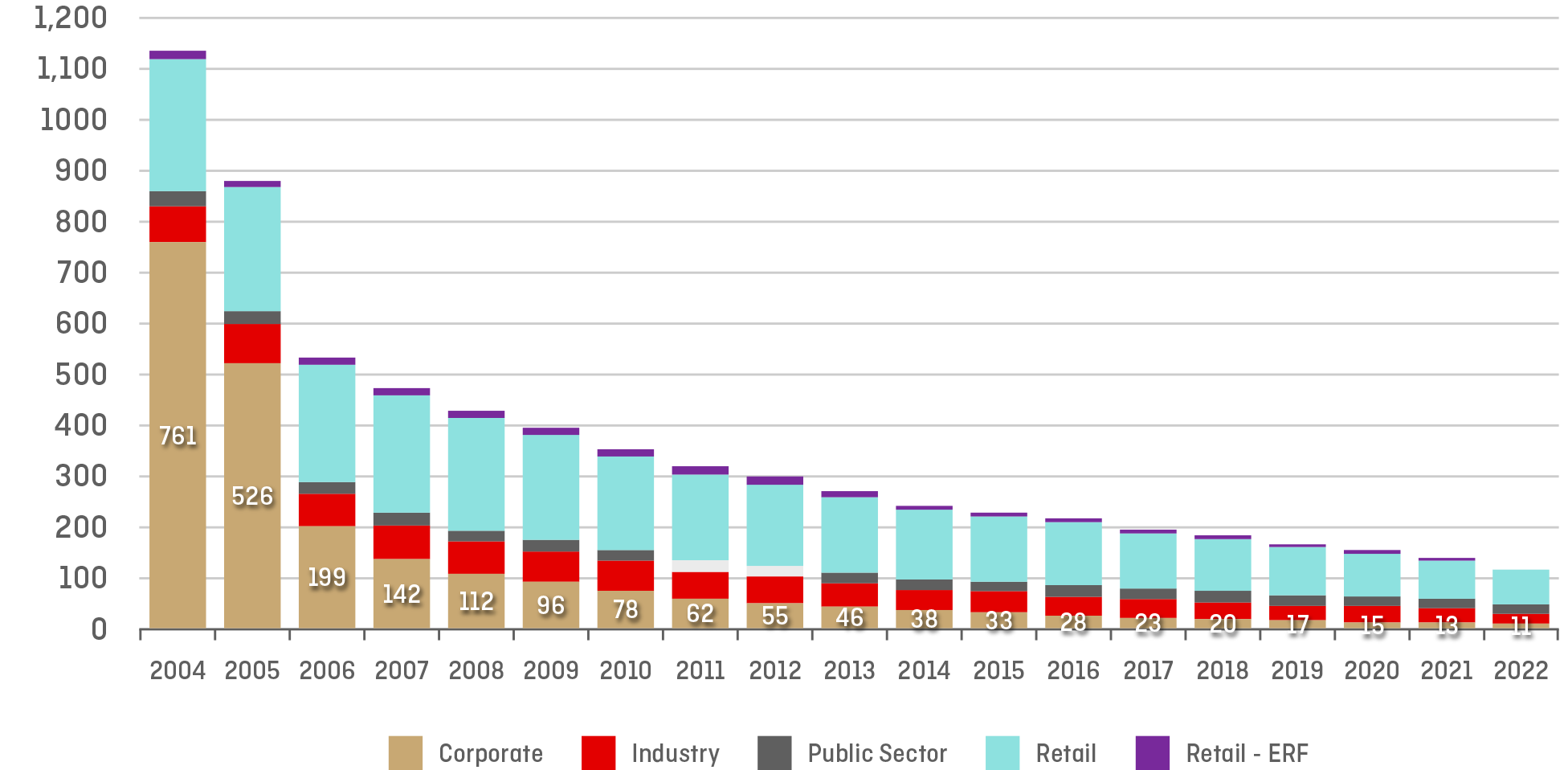

For the past two decades, the $3.5 trillion superannuation industry has been consolidating into a smaller number of ever larger superannuation funds, and the number of corporate superannuation funds has declined at an even more rapid pace. In 2004 there were 761 corporate superannuation funds, a decade ago there were less than 50, and as of June 2022 there were just 11 corporate funds remaining1. Qantas Super is one of the only three comparable corporate superannuation funds who have not announced their intention to merge.

Our focus is on the best financial interests of our members. Any potential merger partner would need to demonstrate their ability to administer defined benefit entitlements and provide our members with equivalent rights to benefits they currently have in Qantas Super. We would also seek to improve member services and lower fees and costs.

The Trustee is acutely aware of the privilege and responsibility it has in managing the superannuation and retirement savings of Qantas Super’s members and will always put members’ best financial interests first.

1 “Annual fund-level superannuation statistics back series June 2004 to June 2022”, APRA, published 14 December 2022

What does this mean for members?

Qantas Super will continue to operate as normal with no changes to members’ defined benefit, defined contribution or income accounts. Members don’t need to do anything.

The process of exploring merger options will take some time. The Trustee understands that many Qantas Super members feel passionately about their Qantas Super account, and we will keep you informed along the way with comprehensive communications and invitations to attend seminars/webinars.

What would happen if we did merge with another superannuation fund?

Our primary focus is always the best financial interests of our members. If a superannuation fund merger were to occur in the future:

- Members in defined benefit (DB) divisions of Qantas Super would have their superannuation interests transferred from Qantas Super to the new fund with equivalent rights to benefits that they currently have. DB members would transfer to the new fund and their employer would continue to support and fund their benefits in the new fund.

- Members in accumulation divisions of Qantas Super would have their superannuation balances transferred to the new fund. Accumulation members would transfer to the new fund and their employer would pay superannuation contributions for these members into the new fund.

We would also seek to improve member services and lower fees and costs.

Importantly, your employers’ obligations to provide superannuation benefits to members would remain the same.

Updates

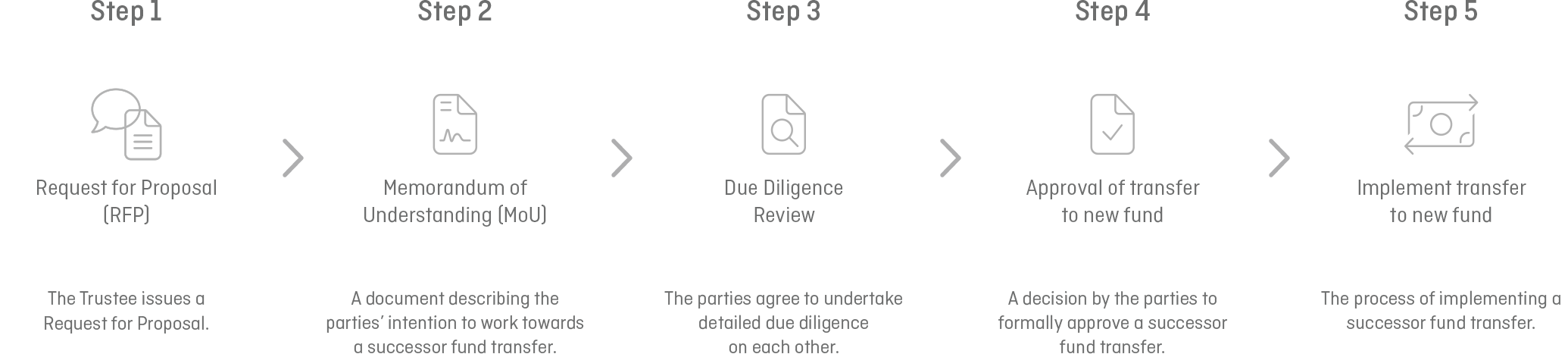

Successor Fund Transfer Process

The Trustee is now at Step 1. The first stage in this process is to commence work on a Request for Proposal (RFP). This means we will issue a request to certain large superannuation funds to submit a competitive proposal to merge with Qantas Super. The Trustee will assess each proposal and form a view as to the best proposal for members and whether this best proposal is better than our current circumstance. In the meantime, Qantas Super will continue to operate as normal with no changes to members’ defined benefit, defined contribution and income accounts. You do not need to do anything.

Frequently asked questions

Please note that these Frequently Asked Questions (FAQ’s) will be regularly updated throughout the process. A * denotes a new or updated question.

Media Release

Where can I find out more information?

The Trustee is committed to keeping members informed at each stage of this process.

If you have any questions about your account, our team is here to help. You can call our helpline on 1300 362 967 or, if you are calling from overseas: +61 3 8687 1866 from 8am to 7pm (AEST/AEDT), Monday to Friday.

The information contained in this site is provided to help members understand their superannuation entitlements in Qantas Super. The information is not intended to constitute financial product advice – general or personal advice. The Trustee recommends that members seek individual financial advice before making any decision.