How to set up your retirement budget

Super is the largest asset most Australians will have, outside the family home. But while it’s exciting to finally get your hands on such a large sum of money, it can be hard to figure out how it will actually translate to a regular income that lasts you a few decades of retirement.

Super is the largest asset most Australians will have, outside the family home. But while it’s exciting to finally get your hands on such a large sum of money, it can be hard to figure out how it will actually translate to a regular income that lasts you a few decades of retirement.

Though it may seem old school, a budget is key. While you’re probably no stranger to the humble budget, there are a few new things to consider as you work out how much to spend in retirement.

How much super do you have and how long will it last?

The biggest factor in creating any budget is determining how much money you have to work with, and how long you’ll need it for.

According to the Australian Institute of Health and Welfare, men aged 65 in 2015-17 have a life expectancy of almost 85, while women aged 65 have a life expectancy of 87 – so your super will need to be with you for quite some time.

As a guide, the Association of Super Funds of Australia (ASFA)’s Retirement Standard estimates that a couple will need a lump sum of $690,000 in combined super savings at retirement in order to enjoy a ‘comfortable’ retirement. A single person, meanwhile, will need a lump sum of $595,000 in super savings.

Broken down into a yearly figure, ASFA estimates that a single retiree aged between 65 and 85 will need an income of $51,278 a year to enjoy a comfortable lifestyle, while a couple will need $72,148 (December quarter, 2023).

These estimates assume that the retirees own their own home outright, are relatively healthy, and will draw down all their capital and eventually receive a part Age Pension.

Of course, everyone’s needs in, and dreams for, retirement are different. You can calculate your income in retirement with our Retirement Income Simulator.

This tool allows you to make adjustments for factors like your personal desired annual income, one-off purchases like a car, the age pension, and any other investments or income you may have from other sources, to show you how long your super will last.

How will your expenses change?

One of the biggest changes to your budget in retirement will likely be your expenses.

As some expenses disappear, like your transport costs to and from work, there may be new ones that arise.

Some of these may be more fun than others – perhaps you’re planning to travel more than you currently do.

On the other hand, as you get older, your health needs change and you may need to spend more on health-related expenses.

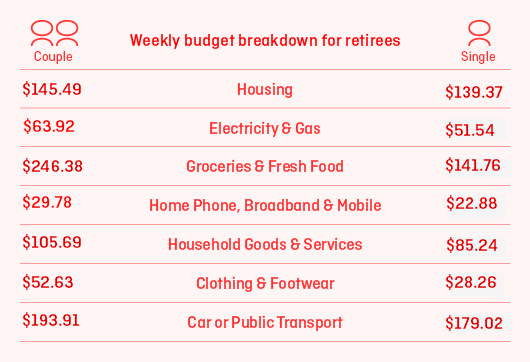

As a guide, ASFA’s Retirement Standard (December quarter 2023) estimates retirees aged 65 to 85 enjoying a comfortable lifestyle will spend the following in an average week:

How often do you want to get paid?

This is perhaps the biggest question you need to consider not only when setting up your budget, but also when choosing where to keep your super.

This is because there are different requirements depending on the type of account you keep your super in during retirement.

In a super account

A regular super account doesn’t come with a minimum drawdown rate, which means you can withdraw as much or as little as you choose, whenever you’d like.

However, you will need to make a new request each time you want to make a withdrawal. For example, you’ll need to fill out a form each time you want to make a withdrawal from your Qantas Super account.

Some people choose to take their super out as one big lump sum when they retire. While this can allow you to make big early retirement purchases such as a new car or renovation, or pay down debt, one of the downsides of a lump sum is that you’re effectively moving your funds out of the tax-advantaged super environment.

In an income account

If you transfer your super to an income account, which pays you a regular income stream, you must withdraw a minimum amount of super each year.

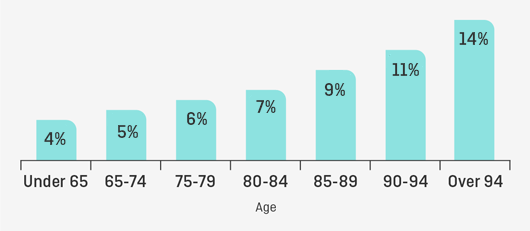

This rate is set as a percentage of your balance on 1 July each year, and depends on your age.

From 1 July 2023, the minimum drawdown rates are:

For example, a member who starts their income stream at age 65 with a balance of $500,000 must withdraw a minimum of $25,000.

By using this rate as a base, you can then tailor the income stream you need from your income account to your budget.

This can help you work out whether you want to receive fortnightly, monthly, quarterly, or annual payments, and how much you need in each payment. You can also make larger withdrawals whenever you choose.

If you open an income account as a transition to retirement member, maximum drawdown limits will also apply.