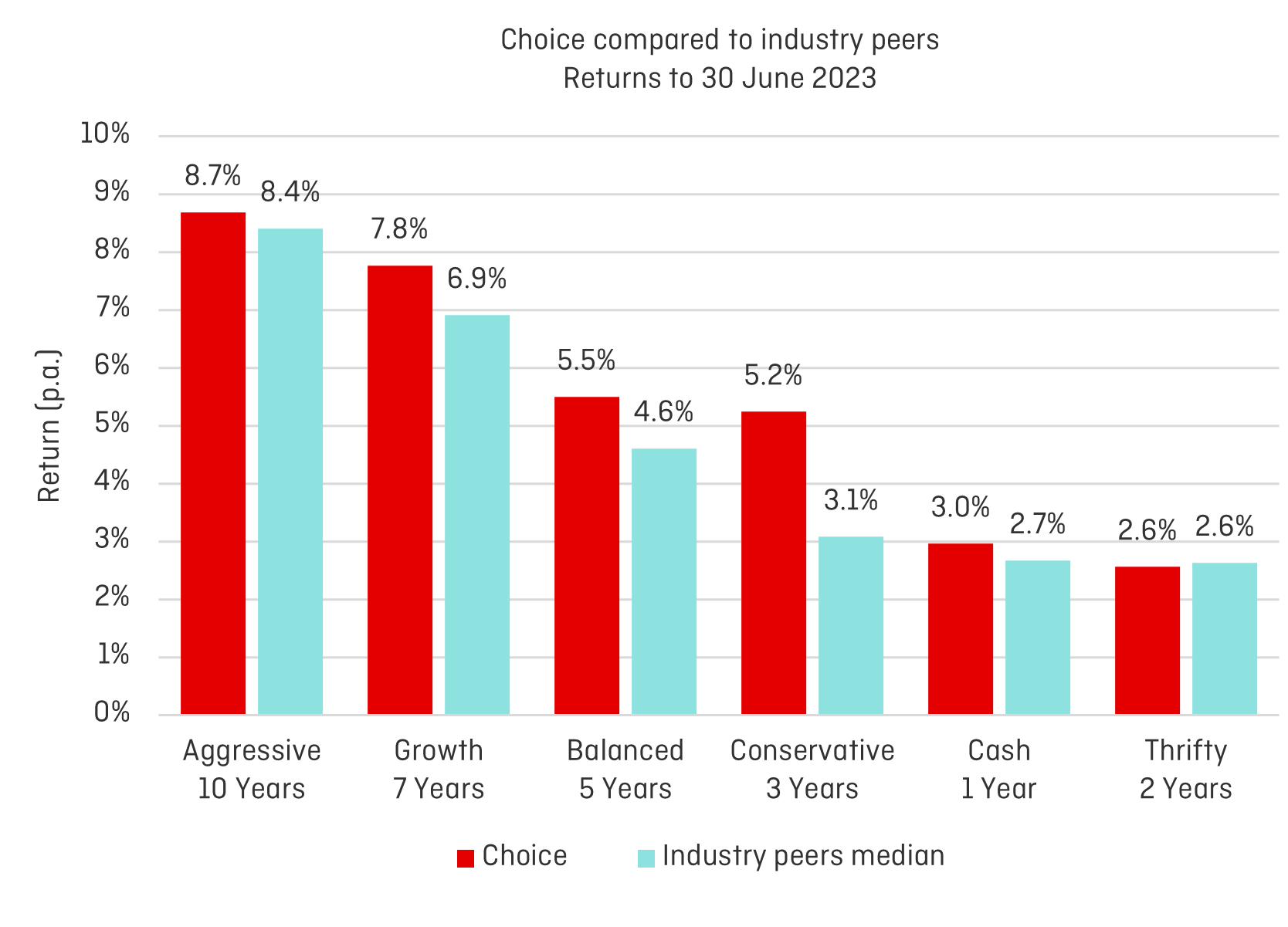

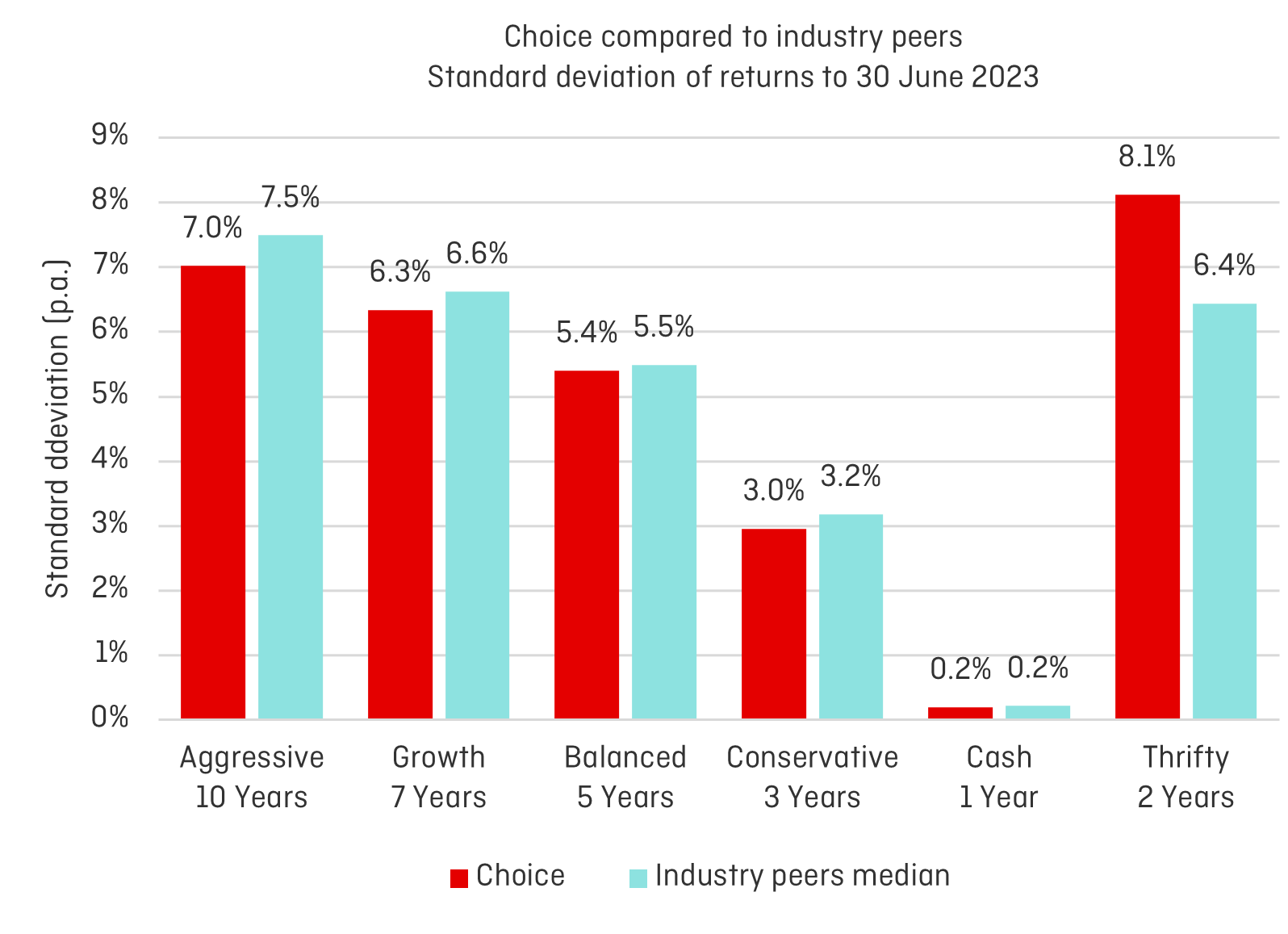

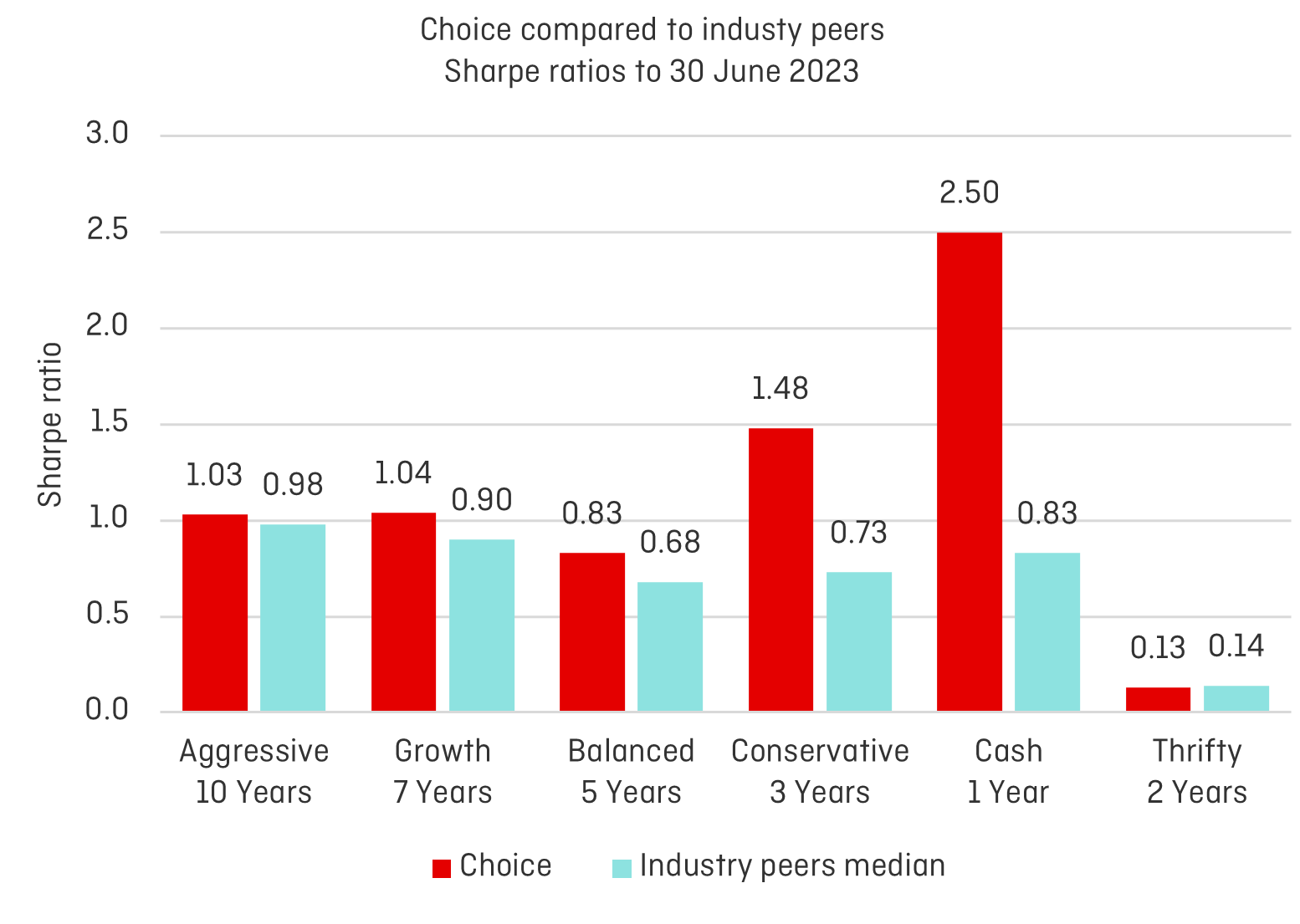

We have assessed each choice investment option separately. We have taken this approach so that each investment option can be more easily compared to industry peers. We used survey data from SuperRatings as the basis for our assessment of our choice products.

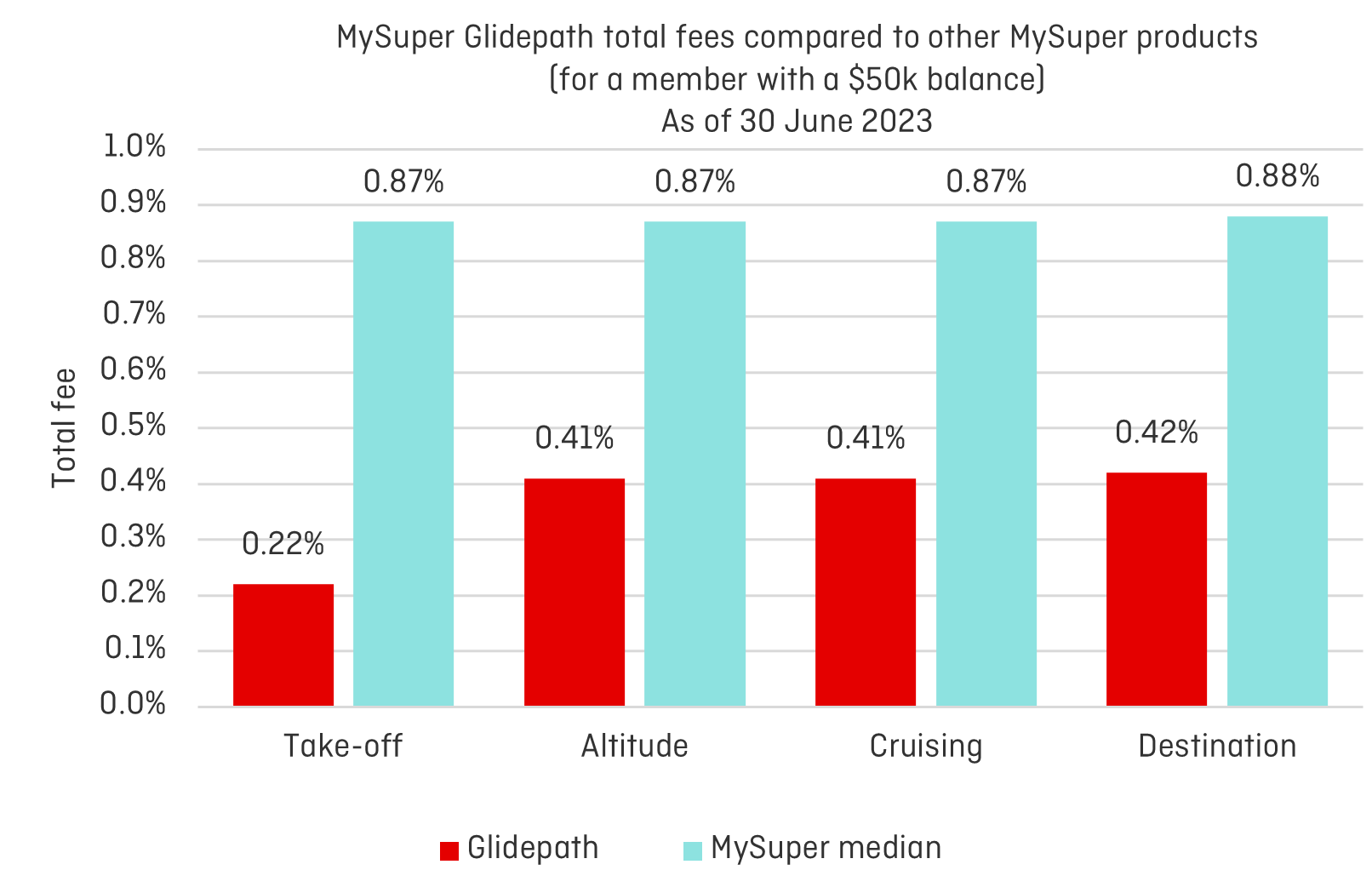

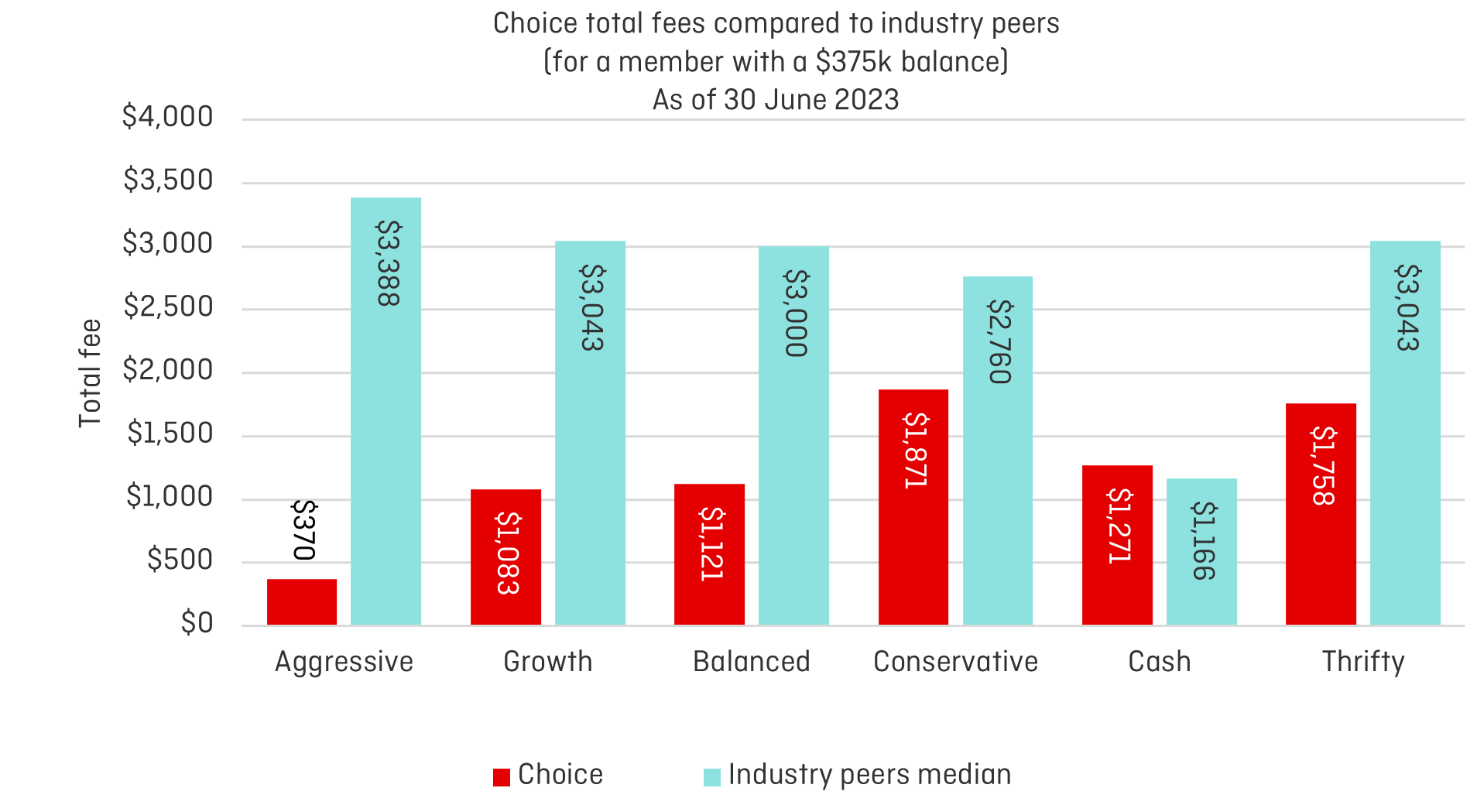

Fees (i.e. which includes investment management fees, investment performance fees and administration fees), for our choice product are shown below in dollar terms for a member with a $375,000 balance (a balance that is closes to the average balance of members in our choice products).

Qantas Super’s total fees for the established choice investment options as of 30 June 2023 were significantly lower than the median fees of comparable products in the industry. This follows the FY2021/22 Member outcomes assessment in which our choice product total fees were significantly higher than those of industry peers. The FY2021/22 choice product total fees outcome was a direct result of the excellent investment performance achieved during that financial year, which in turn led to an increase in investment performance fees attributed to our external investment managers. FY2022/23 saw the reversal of a significant amount of these investment performance fees accrued in FY2021/22, which resulted in our total fees for the choice investment options being well below the total fees of the median fees of comparable products in the industry as of 30 June 2023. It is important to note that the great investment returns shown previously in this FY2022/23 Member outcomes assessment are after investment management fees and investment performance fees have been deducted, and are also net of tax.

In addition, Qantas Super’s investment fees reflect our well diversified investment strategy, which includes allocations to various alternative sub-asset classes. While the investments within these alternative sub-asset classes are more expensive than traditional asset classes, they are expected to materially enhance the returns of our investment options over the long term, despite the short term variations that we have seen over the last two financial years.

Total fees for our low-cost investment option Thrifty are significantly lower when compared to industry peers but in line with the total fees of other more passive industry peer options.