Qantas Super is a not-for-profit fund, which means all our fees go to providing you with the products and services you need to make the most of your super.

This also means we’re always conscious of expenses, and work hard to make sure the fees you pay are good value for money – over the last two years alone, for example, we have lowered admin fees and launched Thrifty, a lower-fee investment option.

At the same time, we’ve also maintained our focus on delivering for you. Leading independent research agency SuperRatings this year awarded our MySuper product a Gold rating for the 11th year in a row, while our Income Account picked up a Platinum rating1. SuperRatings assesses superannuation products across several criteria such as investment performance, fees, insurance, and member servicing.

In addition, all of our investment options provided strong performance over the medium to long term, and ahead of industry medians (except Thrifty which launched in 2021) over the past 3, 5, and 7 years2. While past performance isn’t necessarily a good indicator of future performance, we’re continuing to work hard to deliver strong investment results going forward.

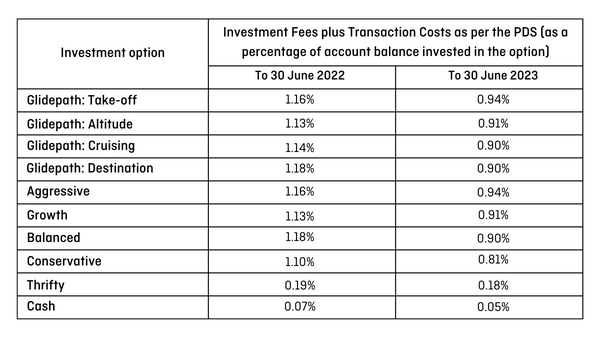

While we’re proud of our products and services, we’re constantly looking to improve. That’s why we’re lowering costs again from 1 July 2023, when premium rates for Voluntary Cover for total and permanent disablement (TPD) are decreasing. We’re also pleased to advise that investment-related fees decreased for the 2022/23 financial year.

1The ratings are issued by SuperRatings Pty Ltd ABN 95 100 192 283 AFSL 311880 (SuperRatings). Ratings are general advice only and have been prepared without taking account of your objectives, financial situation or needs and are only one factor to be taken into account when deciding whether to invest in a financial product. Consider your personal circumstances, read the product disclosure statement and seek independent financial advice before investing. The rating is not a recommendation to purchase, sell or hold any product. Past performance information is not indicative of future performance. Ratings are subject to change without notice and SuperRatings assumes no obligation to update. SuperRatings uses objective criteria and receives a fee for publishing awards. Visit superratings.com.au for ratings information and to access the full report. © 2022 SuperRatings. All rights reserved.

2Performance for Qantas Super investment options is compared to the industry for each respective risk profile in the SuperRatings Fund Crediting Rate Survey as at 31 March 2023. Past performance is not a reliable indicator of future performance. Before considering whether Qantas Super is right for you, consider the PDS and TMDs.

Premiums for Voluntary Cover for TPD are decreasing

From 1 July 2023, premium rates for Voluntary Cover for TPD will be cut by 10 percent.

We have worked with our insurer, MetLife, to review premium rates considering the lessened impact of COVID-19 on the global aviation industry. We will continue to monitor this and other factors to ensure the insurance premiums you pay are fair.

You can find the new premium rates here.

Investment-related fees have reduced

Changes to when insurance cover stops and standard exclusions

There are a number of events which will cause your insurance cover to cease, such as not having enough money to cover the cost of your premiums, if you are on leave of absence for more than seven days (for IP cover), or if you cancel your cover. Under the current insurance policy terms, serving in the armed forces will cause a member’s insurance cover to cease. This means that insurance cover in Qantas Super can only be reinstated upon returning to work and successfully completing the underwriting process.

From 1 July 2023, service in the armed forces will no longer cause cover to cease, but will instead become an exclusion under the terms of Qantas Super’s insurance policy with our insurer.

| Before 1 July 2023 | After 1 July 2023 |

|---|---|

| Your cover ceases on the day before you commence service in the armed forces of any country, including Australia (excluding the Australian Defence Force Reserves not deployed overseas). In addition, an exclusion for any service in the armed forces (including the Australian Defence Force Reserves) applies for IP cover – that is, if you served before or after starting employment at the Qantas Group or served in the Reserves at any time. | If you serve in the armed forces of any country, including Australia, your cover won’t cease. Instead, an exclusion will apply to any type of cover you have. For death and TPD cover, this means you won’t be paid an insurance benefit if your death, illness or injury, is directly or indirectly caused by your service in the armed forces of any country (where the service occurs on or after 1 July 2023 and after the date you joined Qantas Super), other than service in the Australian Defence Force Reserves not deployed overseas. The previous exclusion for service in the armed forces has not changed for IP. |

A minor correction to eligibility for TPD

Last year, we got in touch to let you know about a few changes we made to the insurance available through Qantas Super.

As part of these changes, we amended a definition of TPD to make it fairer for members making a claim. Unfortunately, the communication we sent you had an omission – we incorrectly removed a note specifying that members of Divisions 3A, 5, 6, 7, and 10 may be eligible to make a claim for default TPD cover under the definition of ‘Part (b) Specific Loss’.

The definitions of TPD currently apply as follows:

| Division | If you are employed or have been unemployed for less than 6 months | If you have been unemployed for 6 months or more or are occupied in home duties |

|---|---|---|

| 3A, 5, 6, 7, 10 | Part (a), (c) or (d) applies1 | Part (c) or (d) applies1 |

1If you joined Qantas Super in a division other than Gateway and have continuously held cover since before 1 July 2013, an additional part (b) Specific loss is available to you.

These definitions are:

- Part (a): Any occupation

- Part (b): Specific Loss

- Part (c): Activities of Daily Work

- Part (d): Home Duties

You can find each of these definitions here.

We're here to help

If you have any questions about this and what it means for you, you can book a one-on-one appointment with a Super Adviser as part of your membership.